Risk Control Software: Simplify EU AI Act Compliance

In the modern business world, dealing with risk isn't just about playing defense anymore—it's a critical part of your strategy. Risk control software gives you a single place to find, analyze, and handle threats across your entire company. It’s a massive leap forward from juggling spreadsheets and just reacting to problems as they pop up.

This kind of tool is essential for managing everything from everyday operational hiccups to big new regulations like the EU AI Act, which places strict obligations on how organizations develop and deploy artificial intelligence.

How Risk Control Software Tackles Today's Threats

Business risks have gotten a lot more complicated. A problem in one area can quickly spiral into others. Think about it: a supply chain delay can cause a cash flow crunch, or a small cybersecurity oversight could lead to a huge compliance violation. These threats are all connected, and they move fast.

Trying to track all of this manually is a losing battle. This is where risk control software steps in, acting like a central command center for all things risk-related. Instead of different teams working in their own little bubbles, the software pulls everything together into one clear picture. It helps you see how a weak spot with a third-party vendor might connect to an internal process flaw, for instance.

Getting Ahead of Governance

The biggest change this technology brings is a shift from being reactive to proactive. You're no longer just logging incidents after the damage is done. Now, you can use the software to run "what-if" scenarios, check if your controls are actually working, and spot trouble on the horizon.

This is especially crucial with new rules coming down the pipeline. Take the EU AI Act, which sets some tough standards for anyone building or using artificial intelligence. A good risk platform helps you get ready by:

- Categorizing AI Systems: It gives you a clear framework to sort your AI tools into the Act's risk levels (like unacceptable, high-risk, or limited-risk).

- Automating Assessments: The software helps you run the required fundamental rights impact assessments and conformity assessments to document potential issues and prove you’re compliant.

- Maintaining Audit Trails: It keeps a detailed, unchangeable record of all your risk management steps, so you're always prepared for an audit.

Getting ahead of governance isn't just about dodging penalties; it’s about earning trust with your customers and partners. The market clearly sees the value here. The global risk management software market was valued at USD 9.48 billion in 2021 and is projected to reach USD 13.53 billion by 2025. You can dig deeper into data on this market growth trend.

By centralizing risk data and automating compliance workflows, organizations can transform regulatory burdens like the EU AI Act into an opportunity to build more resilient and trustworthy operations. It turns compliance from a checkbox exercise into a competitive advantage.

What Risk Control Software Actually Does

Think of risk control software as your company’s command center. It’s the tool that helps you spot, understand, and act on threats before they spiral out of control, shifting your entire organization from putting out fires to preventing them in the first place.

Instead of digging through scattered spreadsheets, endless email threads, and siloed reports, this software gives you a single, unified map of your entire risk landscape. It connects the dots between different departments, showing you exactly how a small hiccup in operations could blow up into a major financial or legal problem down the road.

It’s the difference between looking at a single puzzle piece and seeing the whole picture. That kind of clarity is what lets you make smart decisions with confidence.

Breaking Down the Core Functions

At its core, risk control software runs on a continuous, four-stage cycle. It’s not a "set it and forget it" tool. It’s a living system that constantly adapts as your business changes and new threats pop up.

Here’s how that cycle works:

- Risk Identification: The software actively scans for potential trouble spots across the entire business. This could be anything from a weak link in your supply chain to new compliance hurdles like the EU AI Act.

- Risk Assessment: Once a risk is flagged, the system helps you figure out how likely it is to happen and how much damage it could do. This is crucial for prioritizing what needs your attention now.

- Risk Mitigation: Here, you develop and assign concrete action plans to reduce the chance of a risk occurring or to lessen its impact if it does. It's about building your defenses.

- Risk Monitoring: Finally, the software keeps an eye on how well your controls are working and watches for any new or evolving threats. This ensures your risk strategy never gets stale.

This constant loop is what keeps your business resilient.

From Theory to Real-World Application

Okay, let's get practical. How does this actually play out in a real business? A dedicated platform turns risk management from a theoretical headache into a real strategic asset that protects your company’s future.

Take a fintech company building a new AI-driven tool for loan approvals. Under the EU AI Act, this kind of system is considered high-risk and comes with a mountain of rules.

Instead of just using a checklist, the company uses its risk control software to:

- Identify and Classify AI Risk: The platform immediately flags the AI model as a high-risk system under the Act's criteria, kicking off a specific workflow to manage obligations for data quality, technical documentation, and human oversight.

- Assess Impact: It calculates the potential fallout, which could range from massive regulatory fines—up to €35 million or 7% of global turnover—to severe brand damage if the AI unfairly discriminates against certain groups.

- Mitigate the Threat: The software then assigns tasks to the right people. Data scientists are tasked with building in fairness checks, while the legal team is prompted to complete the mandatory conformity assessments. Every action is tracked in an audit-ready log.

- Monitor Performance: After the tool goes live, the system continuously monitors the AI’s outputs for any signs of drift or bias creeping in, sending an alert if things start to go off-course.

This gives them a structured, defensible process that keeps regulators, investors, and customers happy.

Risk control software provides the framework to manage not just what could go wrong, but also to prove that you have taken responsible steps to prevent it. It’s about building operational resilience and provable compliance simultaneously.

Now, think about a manufacturer with a complex global supply chain. A manual review might completely miss a critical weak point. The software, on the other hand, can map the entire network and flag that a key component comes from a single supplier in a politically volatile region. It then helps the team build a mitigation plan, like finding and qualifying a backup supplier, long before any disruption ever hits.

In both examples, the software allows the business to get ahead of the problem, turning a potential crisis into just another manageable task.

How Risk Control Software Tackles the EU AI Act

This pyramid graphic from the European Commission is the key to understanding the AI Act. The concept is simple: the greater the potential risk to fundamental rights and safety, the stricter the rules. The real challenge is figuring out where your AI systems land on this pyramid and then managing all the obligations that come with it.

Getting your AI strategy aligned with the EU AI Act isn’t about a last-minute scramble. It’s about building a solid, repeatable process. This is exactly where modern risk control software comes in—it provides the structure you need to turn dense legal requirements into practical, day-to-day workflows.

Think of the software as a translator. It takes the legal language of the Act and converts it into concrete tasks, controls, and reports your teams can actually work with. Instead of treating compliance as a separate headache, it gets woven right into your existing risk management cycle.

The real power of risk control software here is its ability to create a single source of truth for all your compliance activities. It makes sure your efforts are documented, provable, and ready to stand up to any regulatory questions.

Making Sense of the AI Risk Pyramid

The EU AI Act is smart; it’s not a blunt, one-size-fits-all law. It categorizes AI systems into different risk levels, and your workload depends entirely on where your AI tools fall.

Risk control software gives you a reliable way to figure this out. It helps you systematically check your AI systems against the Act’s definitions so you know exactly what you’re dealing with.

- Unacceptable Risk: The software helps you identify and flag any systems that fall into this banned category—like social scoring tools—preventing you from accidentally deploying something that’s illegal.

- High-Risk: This is where the software really proves its worth. For these systems, it provides the specific templates and workflows you need for mandatory conformity assessments, fundamental rights impact assessments, and detailed technical documentation.

- Limited Risk: Think of chatbots. For these, the software can set up automated checks to ensure you’re always reminding users they’re talking to an AI, meeting transparency rules.

- Minimal Risk: Even for the lowest-risk AI, the platform helps you document why it was classified that way, creating a clear audit trail of your decision-making.

Getting this classification right is the first, most critical step. Without a clear and defensible map of your AI inventory, compliance is just a guessing game.

A Real-World Example: A High-Risk AI Hiring Tool

Let's walk through a common scenario. Imagine your company wants to use a new AI-powered tool to screen resumes. Under the EU AI Act, this is a classic high-risk system because it has a major impact on someone's ability to get a job. Trying to manage the compliance for this with spreadsheets and email chains is a recipe for disaster.

Here’s how risk control software changes the game.

First, the platform would walk your team through a classification questionnaire. Based on its purpose—screening job applicants—the tool is automatically flagged as high-risk. This immediately kicks off a pre-built compliance workflow, ensuring no crucial steps are ever missed.

Next, the software helps automate all the mandatory paperwork. It has templates for things like the Annex IV technical documentation, prompting the right people to provide details on data governance, model training, and performance metrics. All of this information is stored in one central place, complete with version history.

Keeping Up with Ongoing Compliance and Oversight

Compliance isn't a one-and-done task; it's a continuous process. The software is designed to manage the AI tool's entire lifecycle.

- Monitoring for Bias: It can connect with the AI system to keep a constant eye out for algorithmic bias. If the model starts unfairly favoring certain candidates, the software automatically triggers an alert and assigns an incident to your data science team to fix it.

- Managing Human Oversight: The Act requires real human oversight for high-risk AI. The software makes this practical by creating workflows where a hiring manager must review and sign off on a certain percentage of the AI's rejections, logging every action for the audit trail.

- Staying Audit-Ready: When regulators ask questions, there’s no panic. You can generate a complete, time-stamped report of every risk assessment, conformity check, and human review with just a few clicks.

This structured approach turns a daunting regulatory hurdle into a controlled, manageable process. For a deeper dive into the regulation itself, our guide on the EU Artificial Intelligence Act offers more context. By using risk control software, companies can do more than just comply—they can build AI that is genuinely more trustworthy and responsible.

What to Look for in AI Compliance Software

Picking the right risk control software is more than just a procurement decision; it’s about arming your team with the right capabilities for a new regulatory era. To truly get a handle on the EU AI Act, you need a platform that does more than just list potential problems. It needs to be an active partner in monitoring, automating, and demystifying your entire AI landscape.

Think of these features as the core of a proactive compliance strategy. They’re what will graduate you from clunky, error-prone spreadsheets to a system of constant, automated vigilance.

Unified Dashboards and Real-Time Monitoring

First things first: you need a single source of truth. A top-tier risk control platform gives you a centralized, real-time dashboard showing you the health of all your AI systems in one shot. This isn't just a static report that's outdated the moment it's printed; it's a live, dynamic picture of your risk posture.

Imagine seeing at a glance which AI models are tagged as high-risk, the progress of their required assessments, and any active incidents, all from one screen. This kind of unified view breaks down the walls between legal, IT, and data science, ensuring everyone is on the same page. That clarity is absolutely crucial for making smart decisions on the fly.

You can't manage what you can't see. If your AI-related risks are scattered across different spreadsheets and reports, you're flying blind. A real-time dashboard gives you the comprehensive view you need to be in control.

Automated Controls and Continuous Testing

Doing compliance checks by hand is a recipe for disaster—they're slow, inconsistent, and almost immediately out of date. Modern software flips the script by automating this work. It lets you set up automated controls that continuously check your AI systems against specific rules and thresholds drawn directly from the EU AI Act.

For instance, you could set a rule to automatically flag any new AI system that touches biometric data, which then kicks off the required high-risk assessment workflow. Or, a control could constantly monitor an AI-powered hiring tool for bias, sending an alert if its decisions start to favor one demographic over another. Automation makes compliance a daily operational reality, not a once-a-year scramble.

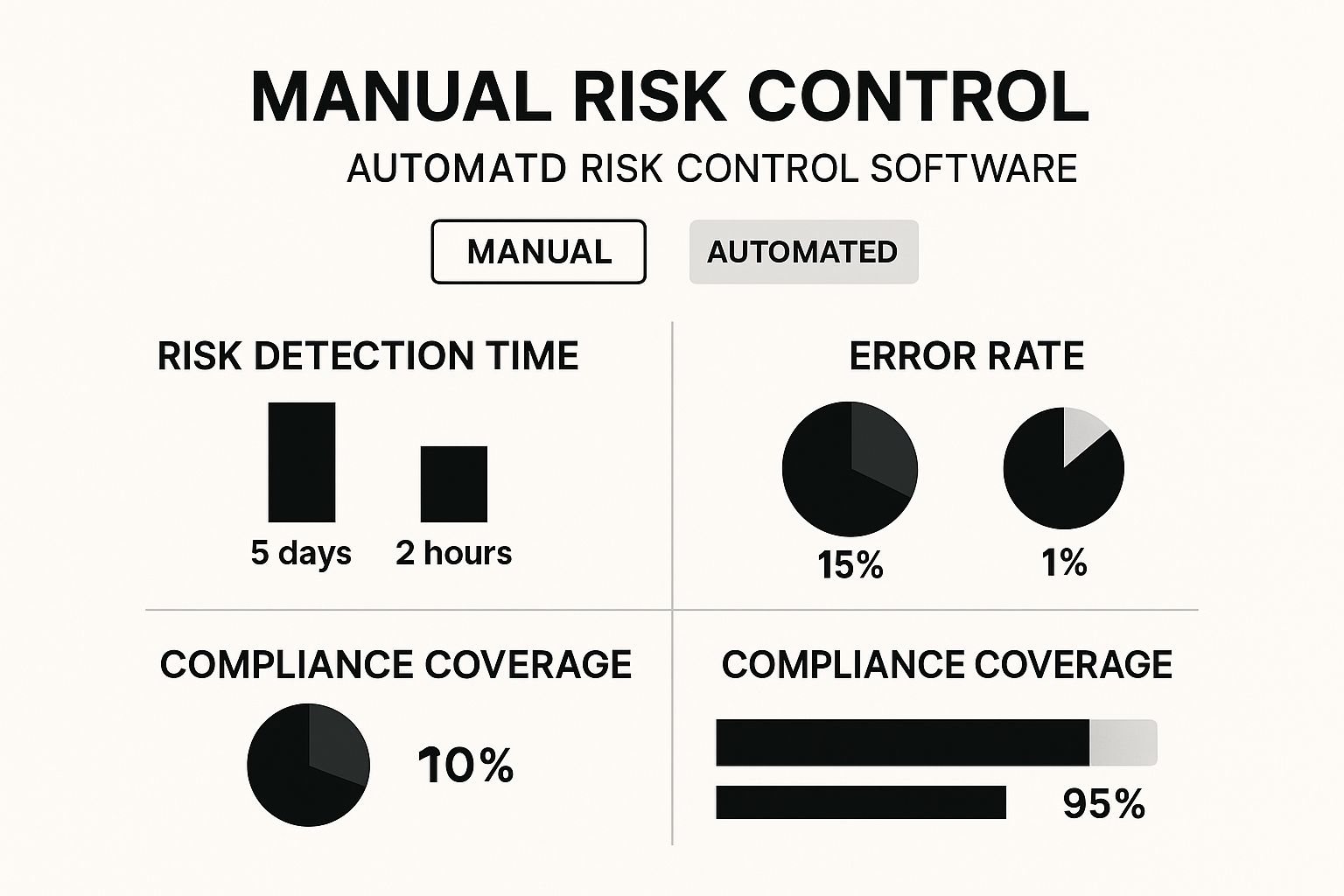

As you can see, the switch from manual to automated isn't just a small improvement. It's a game-changer that drastically reduces detection times and error rates while boosting your overall compliance coverage.

To really grasp the difference, let's compare the old way of doing things with a modern software-driven approach.

Traditional vs. Modern Risk Control Methods

| Aspect | Traditional Method (Spreadsheets) | Modern Risk Control Software |

|---|---|---|

| Data Collection | Manual entry; prone to errors and delays. | Automated data feeds from live systems. |

| Monitoring | Periodic spot-checks; risks missed between reviews. | Continuous, real-time monitoring with instant alerts. |

| Reporting | Time-consuming to compile; often outdated on delivery. | On-demand, audit-ready reports generated in seconds. |

| Collaboration | Siloed information; version control is a nightmare. | Centralized platform for seamless team collaboration. |

| Scalability | Becomes unmanageable as AI systems grow. | Easily scales to handle hundreds or thousands of models. |

The table makes it clear: relying on spreadsheets for something as critical as AI compliance is like trying to build a skyscraper with hand tools. It's just not fit for the job.

Specialized AI Governance Modules

Generic risk platforms often struggle with the unique quirks of artificial intelligence. That's why you should look for software with features built specifically for AI governance.

These specialized modules are what give you deep, contextual control:

- Model Risk Management: This feature acts like a flight recorder for your AI, tracking its entire journey from development and validation to deployment and eventual retirement. It logs everything—data sources, training methods, performance metrics—creating an airtight audit trail.

- Bias Detection Analytics: A must-have for EU AI Act compliance, this integrates tools that actively scan model outputs to find and measure unfair bias. It provides the hard evidence you need to prove your AI systems are equitable.

- Regulatory Change Tracking: The AI legal landscape is anything but static. This feature keeps an eye on updates from bodies like the European Commission, alerting you to changes that impact your compliance duties and helping you stay ahead of the game.

Incident Management and Audit-Ready Reporting

When something goes wrong, you need a clear, coordinated response plan. An integrated incident management workflow is non-negotiable. If a control flags an issue, the system should automatically log an incident, route it to the right team, and track it all the way to resolution.

Finally, the software must be able to generate audit-ready reports at the click of a button. This feature pulls all your risk assessments, control tests, incident logs, and technical documents into a single, time-stamped report you can confidently hand over to regulators. This is why the Enterprise Risk Management (ERM) software market was valued at USD 3.9 billion in 2023 and is projected to reach USD 7.1 billion by 2032. As you can read in the research on the global ERM software market growth, this surge is driven by regulatory pressures. Having robust, reportable compliance features isn't just nice to have anymore—it's a core business need.

Choosing the Right Risk Control Software

https://www.youtube.com/embed/UIg4pwY5k6A

Picking the right risk control software is more than just a procurement task—it's a strategic move. It’s about finding a partner that truly gets your business and can help you navigate tricky regulations like the EU AI Act. This doesn’t have to be a daunting process. If you break it down into manageable steps, you can make a choice you’ll be confident in for years to come.

The first move isn’t to start looking at software demos. It’s to look in the mirror. A comprehensive internal needs assessment is your starting point. This means getting your key people from legal, IT, compliance, and business operations together to honestly map out your company's risk landscape.

What are your biggest operational weak spots? Which of your AI systems are likely to fall into the high-risk category under the new EU rules? Answering these questions first helps you define the problem you're trying to solve. This clarity prevents you from getting dazzled by fancy features you’ll never use or, worse, missing a capability that’s absolutely essential.

Defining Your Core Selection Criteria

With a clear picture of your needs, you can start to evaluate potential software solutions. A structured checklist is your best friend here, helping you compare different platforms on an apples-to-apples basis and find the one that fits just right.

Your must-have criteria should include:

- Industry-Specific Functionality: Generic software rarely cuts it. A healthcare organization has very different needs (like patient data privacy) than a bank focused on financial fraud. Look for vendors who have already solved problems for companies like yours.

- AI Governance Features: This is a deal-breaker, especially with the EU AI Act looming. The platform needs specific tools for classifying your AI systems, running conformity assessments, and keeping an eye out for algorithmic bias.

- Scalability for Growth: The solution you pick today has to work for the company you'll be tomorrow. Make sure it can handle more users, more AI models, and even more regulations down the line without grinding to a halt.

- Seamless Integration: Your new tool can’t live on an island. It has to connect smoothly with the systems you already rely on, whether that’s your CRM, ERP, or cloud platform. Check for solid APIs and pre-built connectors.

Evaluating Vendor Partnership and Support

Remember, you’re not just buying a piece of software; you're entering into a long-term relationship. The quality of a vendor's support team can make or break your implementation, turning a complex project into a smooth rollout.

Choosing a vendor is like hiring a key employee. You're not just buying a product; you're investing in a relationship built on expertise, reliability, and shared goals for success.

Don’t be shy about asking the tough questions. A vendor's experience in your industry is incredibly valuable. For example, the market for financial risk management software was valued at around USD 3.74 billion in 2024 and is projected to soar to USD 14.39 billion by 2034. That kind of growth shows just how critical these specialized tools have become. You can read more about financial risk management market trends to see why.

Before you sign anything, ask for a demo that walks through your specific use cases, not just their standard sales pitch. And always ask for customer references in your industry. A great partner will be transparent and ready to show you they can deliver. For more practical advice, take a look at our guide on choosing the best software for compliance.

Your Implementation and Success Roadmap

Choosing the right risk control software is a huge step, but the real work starts when you turn that purchase into a living, breathing part of your compliance strategy. A successful rollout is much more than just flipping a switch. It’s a full-blown project that demands a clear plan, buy-in from your team, and a commitment to getting better over time.

Think of it less like installing a new app and more like building a new capability from the ground up. The ultimate goal is to weave risk-aware thinking into your company's DNA, and the software is the central nervous system that makes it all work. Let’s break that journey down into four manageable phases.

Phase 1: Strategic Planning and Team Alignment

Before you even think about migrating data, you have to get everyone on the same page. This initial phase is all about defining what a "win" looks like and making sure the right people are in the room from day one.

Here’s what to focus on first:

- Assemble a Cross-Functional Team: You need a mix of minds. Pull in leaders from IT, legal, compliance, and the business units that will actually be using the tool. Their combined perspective is what will make this work.

- Define Clear Objectives: Get specific. What problem are you trying to solve? Is it automating EU AI Act reporting? Getting a better handle on vendor risk? Or both?

- Set Key Performance Indicators (KPIs): You need to measure success. Aim for concrete goals, like cutting audit prep time by 50% or reducing the number of compliance incidents. These metrics will be your proof that the investment was worth it.

Phase 2: System Configuration and Data Integration

Once you have a solid plan, it's time to get technical. This is where you mold the software to fit your company’s unique structure, risk tolerance, and, critically, your obligations under the EU AI Act.

You’ll be setting up risk assessment workflows, configuring alert thresholds, and connecting the platform to your existing systems. A clean data import is absolutely crucial here. Pulling in accurate, complete information about your AI models and internal controls sets the foundation for everything else.

A successful implementation hinges on change management. The technology is only half the equation; getting your people to embrace a new way of working is what truly drives long-term success and builds a resilient culture.

Phase 3: User Training and Phased Deployment

A powerful tool is worthless if your team doesn't know how to use it. Don't skimp on training. Every single person needs to understand their role and how to operate within the new system.

Instead of a big, risky launch, I always recommend a phased deployment. Start small. Pick a single department or one specific risk category for a pilot program. This lets you iron out the wrinkles, collect real-world feedback, and score an early win that builds momentum for the wider rollout.

Phase 4: Continuous Improvement and Optimization

Implementation isn't a "one and done" task—it's the start of a cycle. Once the software is up and running, your focus shifts to monitoring how it's working, listening to your users, and making small, iterative improvements. This ongoing process is at the heart of effective governance, compliance, and risk.

Keep a close eye on your KPIs to see if you’re hitting your targets. Use the software’s own analytics to spot emerging risk trends and adjust your controls accordingly. This dedication to optimization ensures your risk management program grows with your business, keeping you ready for whatever comes next.

Frequently Asked Questions

When you're dealing with something as complex as risk management, especially with big new rules like the EU AI Act coming into play, it's natural to have questions. Let's tackle some of the most common ones we hear about risk control software.

Is This Software Only for Large Enterprises?

Not anymore. It's a common misconception that only giant corporations need or can afford these kinds of tools. While they were certainly the first to jump on board, the market has changed dramatically.

Today, you'll find plenty of scalable, cloud-based options designed specifically for small and medium-sized businesses (SMEs). The pricing is more flexible, and the platforms are built to grow with you, making top-tier risk management accessible to everyone.

How Does It Handle Other Regulations?

A good risk platform is never a one-trick pony. While we’ve been focusing on the EU AI Act, these systems are built to be incredibly adaptable. You can set them up to manage a whole host of regulatory requirements.

Think of it as a central hub for compliance. You can map your controls to GDPR for data privacy, industry-specific rules like HIPAA for healthcare, or financial regulations like SOX. The goal is to avoid starting from scratch every time.

The real power of risk control software is creating a single, unified framework. You map a control to multiple regulations at once. This "map once, comply many" approach is a game-changer for efficiency.

What Is the Difference Between GRC and Risk Control Software?

This is a fantastic question because the terms are often used interchangeably. Think of Governance, Risk, and Compliance (GRC) platforms as the big-picture strategic tool. They cover the entire organization, from high-level corporate governance and internal audits down to policy management.

Risk control software, on the other hand, is a more specialized tool within that GRC umbrella. It's the hands-on, operational part of the equation—the system your teams use day-in and day-out to actually identify, assess, and deal with specific risks. GRC sets the strategy; risk control software executes it.

Ready to stop worrying about the EU AI Act and start building a provable compliance framework? Discover how ComplyACT AI can get you audit-ready in just 30 minutes. Learn more and secure your compliance today!